MBO Finance | Management buyouts and business liquidity

Pursuing a management buyout (MBO) is extremely demanding. New owners face both financial and emotional pressures, both to complete the deal and to ensure they have the most appropriate finance and resources in place for future success, especially around working capital, our focus in this article.

Putting financial measures in place both pre and post buyout ensures that the business does not suffer liquidity problems after ownership has been transferred.

In an MBO, a company’s management team purchases the assets and operations of the business. It’s unlike a management buy-in, where an external management team acquires a company and replaces the existing management. A management buyout is often an effective exit strategy for a business owner, as the ownership and the control of the business are passed to the hands of a trusted management team.

For the management team, this often represents a once in a lifetime chance to buy a share in a business that they already know and understand, based on an independent valuation.

Benefits of a management buyout:

-

Perceived as low-risk, with less warranty and indemnity cover needed due to the management team’s close working knowledge of the business.

-

The sales process is faster with a requirement for less due diligence than an open market sale.

-

Rewards for the management team are significant, as they can take a share of ownership and determine their own future.

-

The owner has no need to market the company for sale.

-

They can be initiated by the vendor.

However, by necessity, a management buyout tends to be typified by the former owner(s) removing funds from the business, which may not be immediately replaced. This can lead to a reduction in liquidity post-MBO, unless timely incremental working capital provision is put in place.

Pre-MBO funding – the impact on working capital

Pragmatic financial planning is key. The post-MBO financing model must be clearly mapped out to highlight any shortfalls. With this visibility, the new owners may be more able to mitigate against illiquidity and the ensuing paralysis, as well as potential loss of revenue.

MBO financing discussions often focus on the business post-MBO – at this stage liquidity is often pinched following the release of working capital to the vendor.

However, it is often beneficial to add supply chain finance (SCF) to the working capital toolkit prior to the MBO, a tactic often considered where the exit of a vendor is planned in advance (for example, for the succession of a family firm, or when a founder is planning a new venture or retirement.)

This will not only help the management team to prepare for a smooth transition, but also allows them to secure vital subcontractor relationships which may otherwise be put at risk post-MBO, for example if the company extends payment terms to improve liquidity post-MBO.

Pre-MBO funding | a working example

Company X is a manufacturer of fine foods with gross revenues of £48m, supplying schools, hospitals and corporate catering companies across a wide geographic area. Currently a family firm, the business is planning for the exit of the current Managing Director and CFO – a married couple who have run the company between them for the past 27 years.

The CFO is keen to get the business into an even stronger position, so it can continue to prosper post-MBO, in an increasingly competitive market (source: RSM).

She also wants to allay the concerns of a number of key producers in the region, from whom they Company X sources 90% of its fruit and vegetables, prepared fresh ingredients and dairy goods, and who want to understand the possible impact of the transfer of ownership, and whether they will be forced to extend payment terms.

The CFO compares a range of working capital solutions, including ABL (asset-based lending) and a revolving cash facility with their bank. Finding drawbacks with all these options, (such as the bank’s reluctance to lend to a company reliant on a small number of suppliers, due to concentration risk, and reduced drawdown percentage) the CFO approaches TradeBridge for a supply chain finance facility of £1.4 million. Following a meeting of TradeBridge’s Finance Committee, and necessary credit and insurance checks, an unsecured facility is agreed inside five weeks, with the two primary fresh food suppliers joining the programme.

In this way, Company X is able to offer highly favourable payment terms to vital subcontractors, cementing those key relationships, and at the same time improving their own working capital position by extending creditor days.

Post-MBO funding – the impact on working capital

Post-MBO, unless the new owners can pay off the vendor in full immediately, the business may require additional financing.

At the same time, the new owners will typically find themselves with significant personal debt to finance the management buyout. This is a calculated risk for each individual, and the new owners will all be keen to see a return on their invested capital and to repay their debts.

In reality, a return is unlikely until the vendor has been repaid in full. This is much more likely to happen quickly for a business that has a strong supply chain, good relationships with suppliers and the opportunity to drive growth.

A supply chain finance facility may help improve the business’s ability to maintain these important strengths.

The fictitious example below illustrates how this might work in practice.

Funding an MBO| a working example

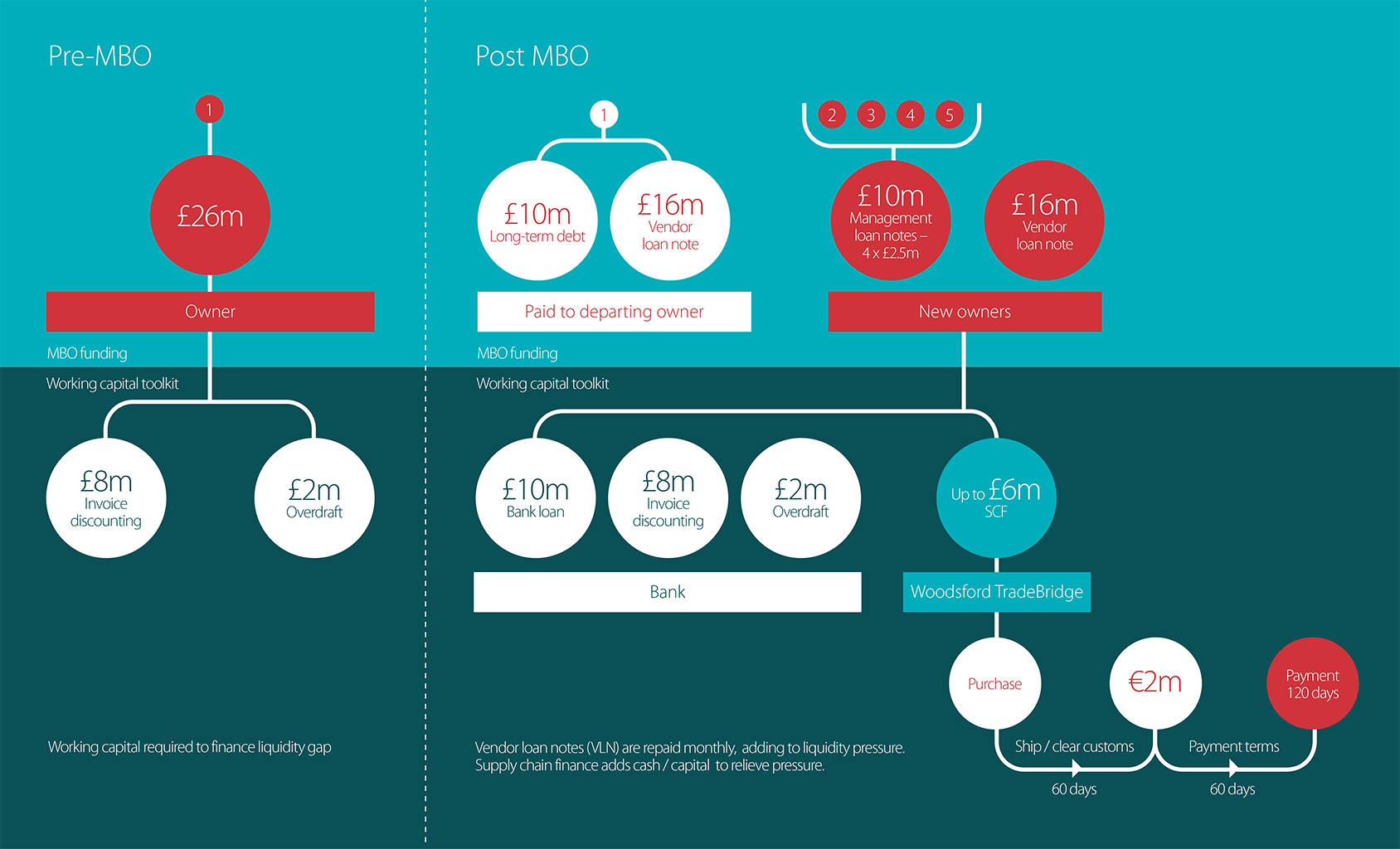

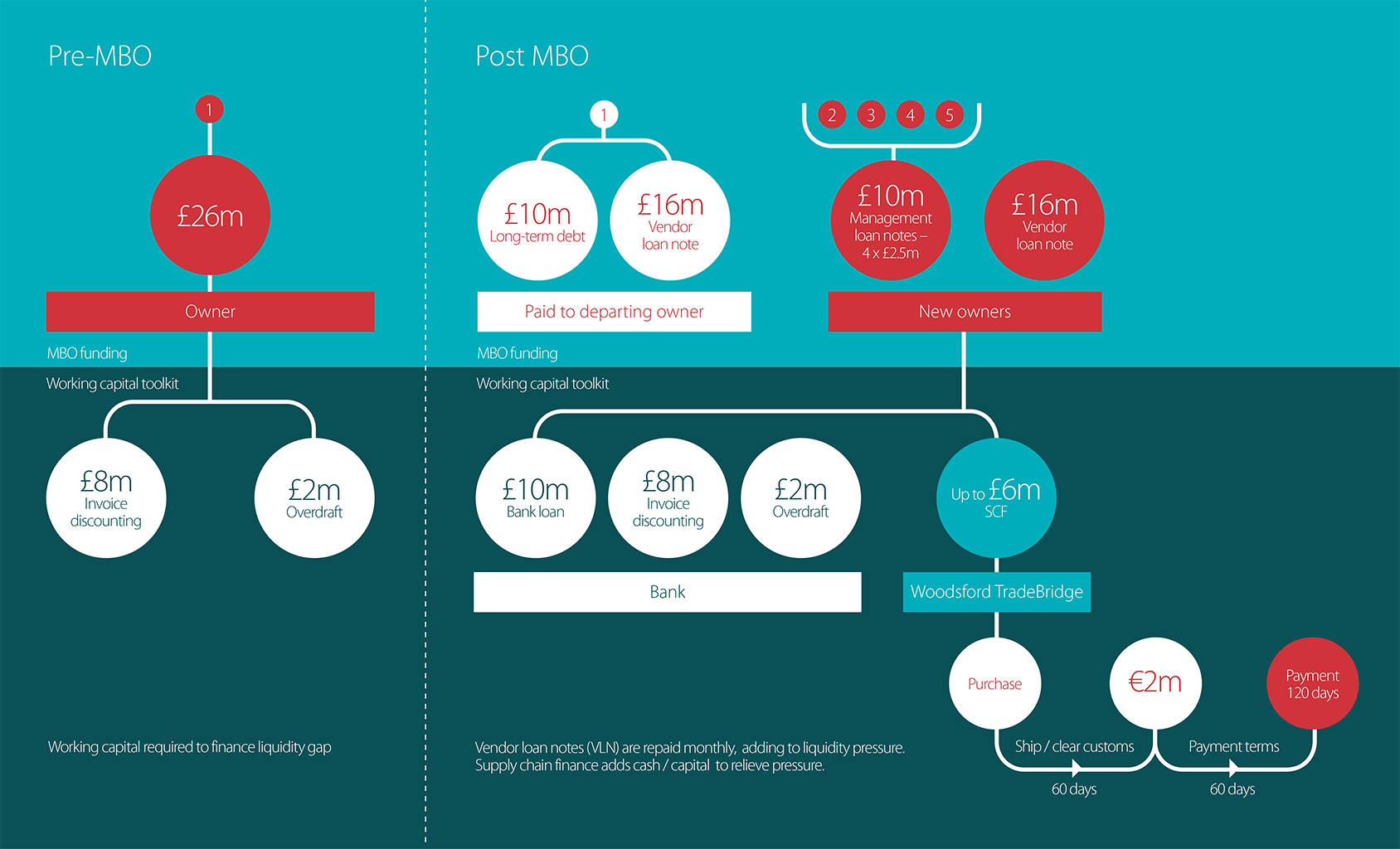

Company Y, a traditional industrial manufacturing firm valued at £26m, holds significant assets in the form of premises, machinery, work in progress and guaranteed orders, supported by a bank overdraft of £2m, and an invoice discounting facility of £8m.

The current owner is approaching retirement and with a clear vision for the future of the business, the management team of four offers him an MBO.

The retiring owner takes £10m from the business immediately, leaving the business owing him £16m, financed in the form of a vendor loan note, to be paid off over a five-year period. To finance the payment of £10m to the retiring owner, the business takes out a secured bank loan of £10m. The business maintains its pre-MBO value of £26M, with management loan notes covering the £16m balance.

The capital owed to the bank, and to the retiring owner, (financed via MLN) will have to be repaid before the new owners can take dividends on their investment – but the long-term prospects are good. However, the working capital in the business is stretched.

As Company Y is a strong business with a good track record and a healthy pipeline, TradeBridge are able to offer a supply chain finance facility (SCF) of up to £6m, used to extend creditor days, to help to reduce pressure on liquidity in the short-term.

The SCF facility is unsecured, and its application is discretionary, making it more attractive than their invoice discounting facility.

Company Y may choose to continue use the facility to better manage their working capital position in the longer-term. This enables the new owners to consider new opportunities such as the modernisation of manufacturing and other strategies for growth, whilst maintaining strong relationships with subcontractors to reduce risk as they grow.

Post-MBO finance and liquidity – conclusions

Post-MBO, many strong and innovative businesses can find themselves approaching illiquidity, with existing ABL (asset-based lending) arrangements restricted.

Supply chain finance from TradeBridge is typically unsecured and can provide the new owners with much needed working capital, allowing the business to secure vital subcontractor relationships, and plan for growth and innovation.

With the right finance in place, companies can excel post-MBO with surveys showing that many do better than their non-MBO peers (source: MBO Group).