This year we partnered with Amazon as one of only two strategic funding providers for their UK sellers. Our bespoke solution offers eligible sellers up to £5 million in growth capital. Securing additional facilities of £170 million, within three months of launch, has increased our capacity to empower marketplace SMEs to achieve their full potential.

Traditional banks, still recovering from the financial crisis, focused on funding larger organisations, leaving SMEs under-served. So, three friends, experts respectively in Finance, Business Management and Supply Chain Management technology, converged to help entrepreneurial companies. They got to work creating a plan and TradeBridge, and its software platform was born.

Their vision, to utilise creative thinking, data, and tech to re-invent supply chain finance, resulted in us signing our first client, a fish farm in Scotland! The year saw the building of both the team and the technology platform to serve our corporate clients, across the energy efficiency, construction and manufacturing sectors.

2015 saw a breakthrough moment, the launch of our innovative, embedded eCommerce finance solution for online marketplaces. In partnership with FARFETCH, a luxury fashion marketplace, the embedded funding solution we developed for their online sellers marked the start of our commitment to funding eCommerce.

We launched RxBridge, finance for the independent pharmacy sector, having recognised they faced similar challenges to our existing client base. Today, we support hundreds of independent pharmacies, providing them with working capital and additional funds to invest in growth strategies. As a result, ABN AMRO, expanded our funding from £15 million to £40 million.

After three years of impressive growth across: eCommerce, pharmacy and corporate businesses, we focused on scalability. We refined our business processes and tapped into London's highly skilled and diverse talent pool. As our global client base grew, we began exploring options for opening TradeBridge's first offshore office.

This year, we chose to expand into Singapore, because of its position as the strategic gateway to the APAC region, a stepping-stone to growing our global client base. Our multi-lingual, multi-cultural team help clients with international supply chains. Whilst in the UK, the team moved to Bloomsbury, an area recognised as the 'intellectual heart' of London.

Early in 2019, we smashed a significant milestone and broke through the $1b funding mark, meaning these funds were supporting hundreds of SME businesses worldwide. The continued success of RxBridge, led us to extend the functionality of this innovative, embedded finance solution, to expand into the UK dental sector.

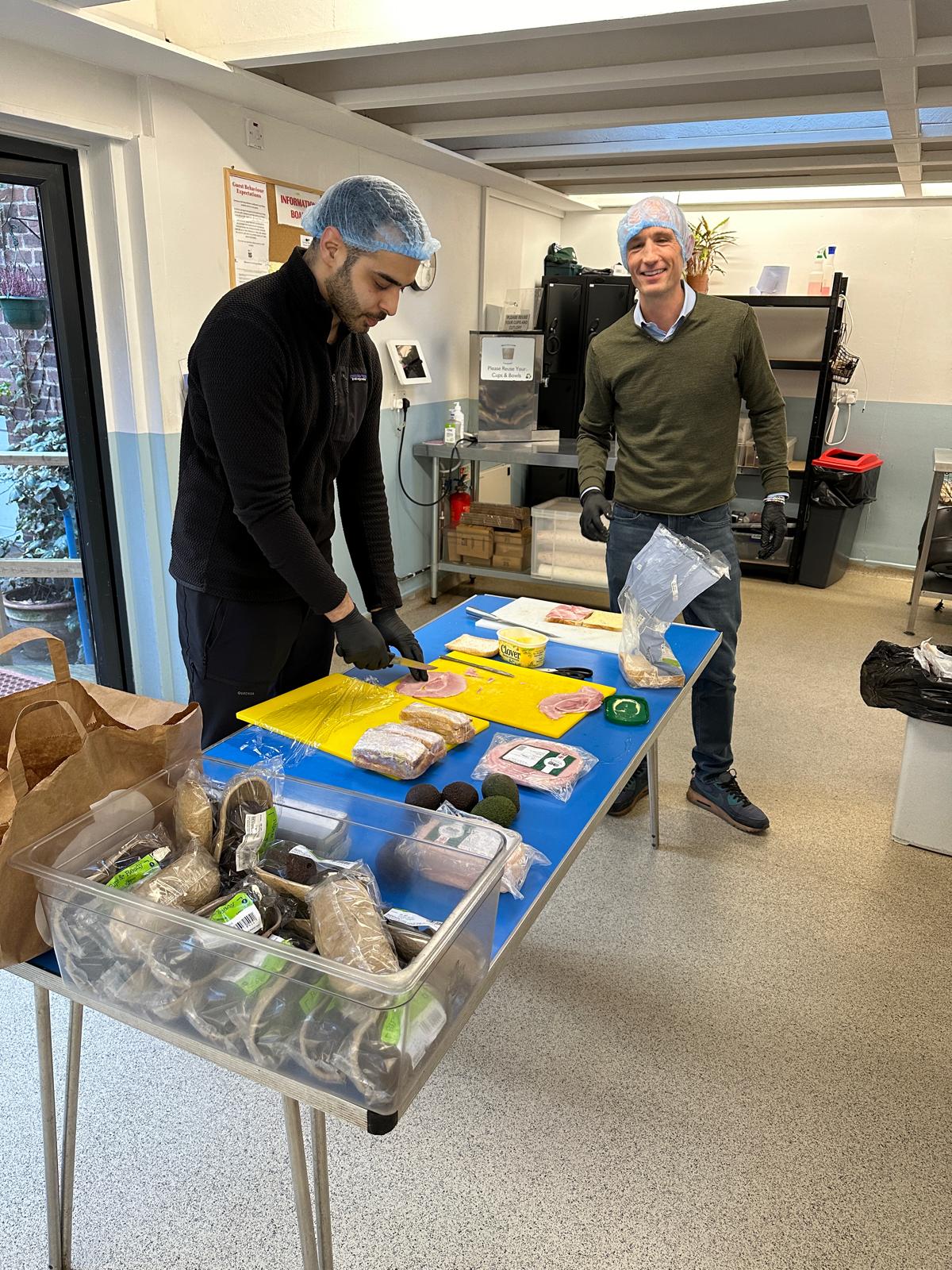

COVID-19 placed the UK’s pharmacies, under significant additional pressure. As the UK government rolled out financial support, our platform was leveraged to deliver and manage vital, emergency funding to pharmacies. Furthermore, with unflinching commitment, we achieved the Coronavirus Business Interruption Loan accreditation, enabling UK SMEs to receive this government funding.

Just two years after surpassing the $1b mark, we reached the $2b funding milestone. This achievement reflected both the loyalty and growth of our client base, and the quality of our product portfolio. This year also secured an additional $100m facility to fuel growth. This marked a significant step in our global expansion.

Our global ambitions advanced as we opened a new office in Australia. Two of our UK team, with deep industry knowledge and experience, were deployed to Sydney to establish and lead the new office. Synergies between Australia’s PBS health service and the NHS, made our pharmacy solution a natural first offering for this market.

This year presented a unique growth opportunity for entrepreneurial pharmacists when LloydsPharmacy revealed plans to sell off 1,294 of it's pharmacies. RxBridge supported the acquisition of one third of the divested portfolio, with pharmacists able to secure acquisitions ranging from a single site, to hundreds of new locations.

With 10 years’ experience funding the energy efficiency industry, (during which we funded over £200m to some 100 installers) we launched Energy Advance. Energy Advance is a bespoke embedded finance product designed for qualified SME installers, leading retrofit programmes, crucial to achieving the UK’s 2050 Net Zero targets.